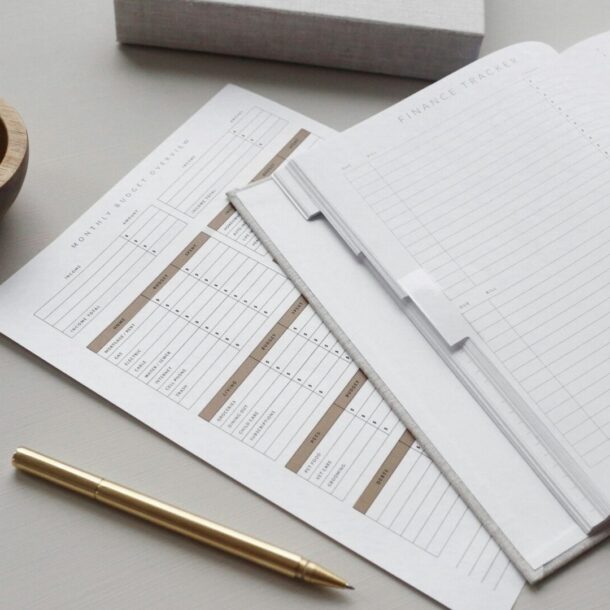

The first time I tried to create a (simple) budget, I failed. I forgot so many costs because I had no Fixed and Variable Expenses Worksheet to guide me. Here’s how I’d go about planning my budget successfully today. The […]...

The trend towards semi retirement is growing for those seeking FIRE (Financial Independence, Retire Early). Our FREE Semi Retirement Calculator shows you how it works so you can retire even earlier than you thought possible and enjoy real work-life b...

To be honest, I don’t like the term “escape the 9-to-5”. But it perfectly describes how learning about semi-retirement lets you work less in your 40s or 50s, enjoy family life more, and achieve financial freedom faster (all while ra...

When you’re investing for passive income, you invest money today to make money tomorrow without the daily effort of working a job. I’ve compiled the 15 easiest and simplest strategies for investing money to generate passive income. If you’r...

Our family uses 7 simple strategies for investing for a monthly income on our journey to FIRE (Financial Independence, Retire Early). Five of these already pay us €1,500 every month. The other two will generate income in the next few […]...

Wondering if and how a master’s degree can accelerate your path to FIRE (Financial Independence, Retire Early) Whether you’re weighing the pros and cons of further education or you already have a master’s and wonder how to use it to...

How to build a budget is a crucial skill for achieving financial well-being and independence. In today’s fast-paced world, personal finance management is more crucial than ever. Creating a monthly budget and maintaining it is a vital step towar...

Hey there, fellas. Let me ask you a question: Have you ever tried talking to your wife about finances and felt like you were navigating a minefield Trust me, I’ve been there. It can be tough, but it’s one of […]...

Struggling to balance work and family, chores and quality time with kids in the evening Discover the best evening routine for working moms to reduce stress, boost productivity, and create a smoother night routine for busy moms like you and […]...

Start your day stress-free with this working mom morning routine checklist. It’s free and editable too! You can use it to create or customize your own. After having two kids (soon to be three), I’ve learned that the key to […]...

Girl, you don’t have to do it all! Discover the best science-backed morning habits for busy working moms that no one talks about for a productive start to the day. This simple step-by-step guide will help you create YOUR ideal, […]...

As a mom of 2 (soon 3) I’ve learned: Moms who wake up early for self-care open up a new world of peaceful mornings. That will not only change your life, but it will also save you money. Here are […]...

Register for our Newsletter

Connect